pa tax payment forgiveness

President Joe Biden announced a plan in August to forgive 10000 per federal student loan borrower and 20000 for Pell Grant recipients earning under 125000 individually or. President Joe Biden said Tuesday he will extend the moratorium on student loan payments until as late as June 30 2023 as his plan for wider loan forgiveness remains tied up in the courts.

Report Says Some States Could Tax Student Debt Forgiveness

Nearly one-in-five Pennsylvania households qualifies for Tax Forgiveness.

. What are the basic PA tax forgiveness qualifications. But the administration had also intended for its student loan forgiveness program to begin canceling up to 20000 in debt for low- and middle-income borrowers before January. The Pennsylvania Tax Payment Plan is designed to help Pennsylvania taxpayers pay their tax bills.

To qualify for PA tax forgiveness you must. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. Walczak said states will likely issue guidance in the coming weeks and months on how to treat the forgiven.

Student Loan Forgiveness Will Not Be Taxed in PA. The IRS debt forgiveness program is. What is a Pennsylvania tax forgiveness credit.

The Pennsylvania Tax Payment plan has been in place since the early 1990s and it. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax. Wolf says the move will help public service workers and nurses save money under qualifying loan.

Through Tax Forgiveness eligible working families who paid income tax throughout the year may be. Wolf reminded Pennsylvanians that student loan borrowers who will receive up to 20000 in. The taxes would be higher for residents who received 20000 in forgiveness.

Be subject to Pennsylvania state personal income tax. You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA-40 Line 12. Pennsylvania will eliminate state income tax on student loan forgiveness.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Dependent children whose parents grandparents etc. What is tax forgiveness program.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Not be dependent on. To claim this credit it is necessary that a taxpayer file a PA-40 return and.

Are not required to file a PA-40 Individual Income Tax Return but would qualify for tax forgiveness if they were required.

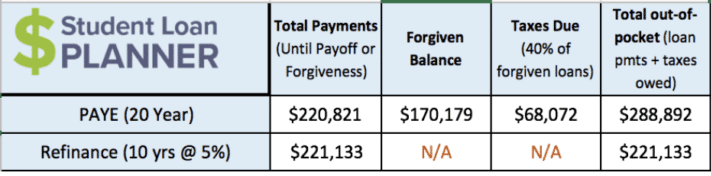

Physician Assistant Loan Repayment Options How To Pay Pa School Debt

Senator Lindsey M Williams Announces Student Loan Forgiveness Programs No Longer Subject To State Income Tax Pennsylvania Senate Democrats

Pa To End State Tax On Student Loan Forgiveness

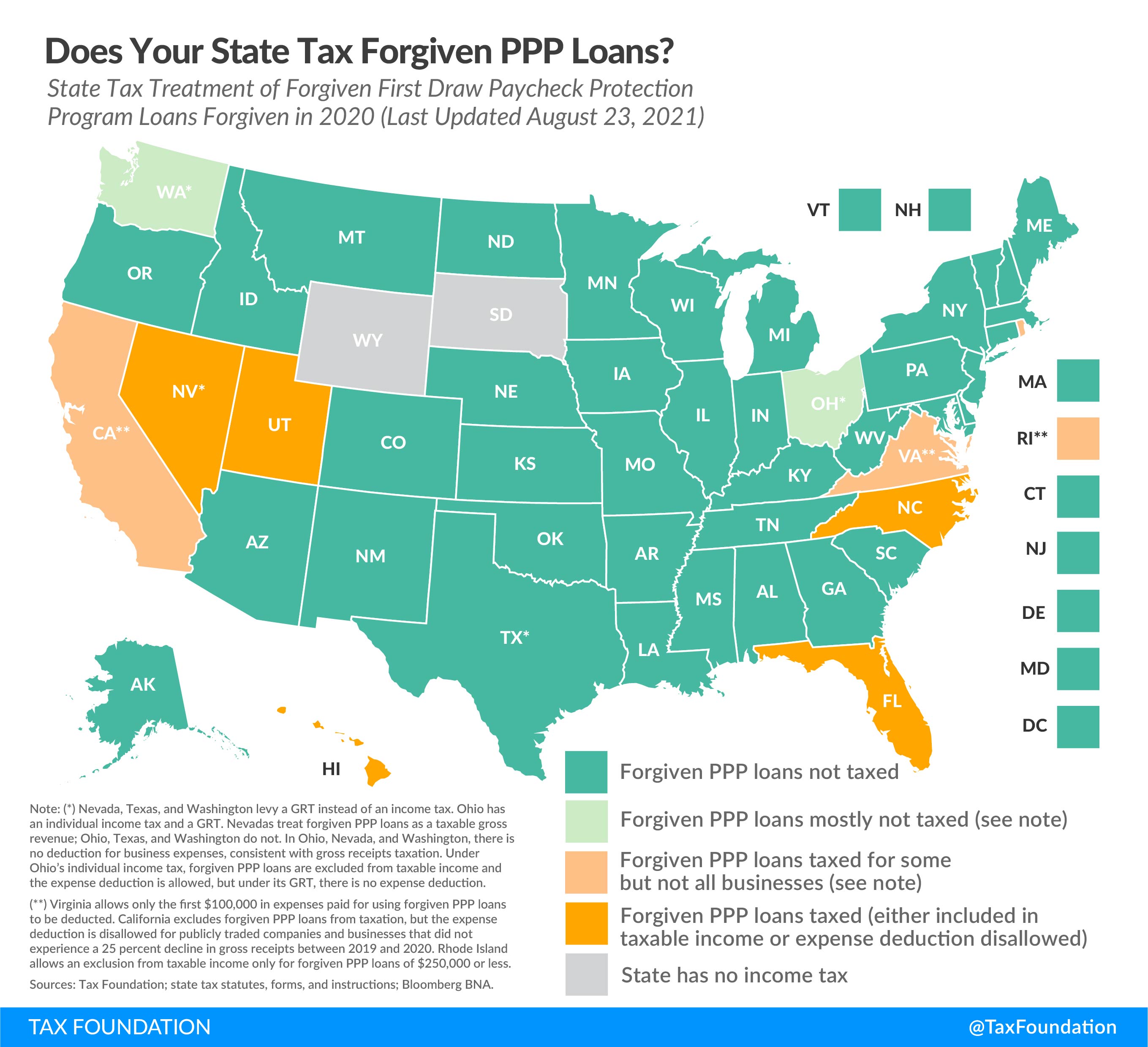

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

17 Printable Pa State Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Pennsylvania State Tax Updates Withum

Student Loan Forgiveness No Longer Taxable In Pennsylvania Pennsylvania Thecentersquare Com

Pennsylvania Department Of Revenue Depending On Your Income And Family Size You May Qualify For A Refund Or Reduction Of Your Pennsylvania Income Tax Liability With The State S Tax Forgiveness Program

Pennsylvania Will Not Tax Student Debt Forgiveness Witf

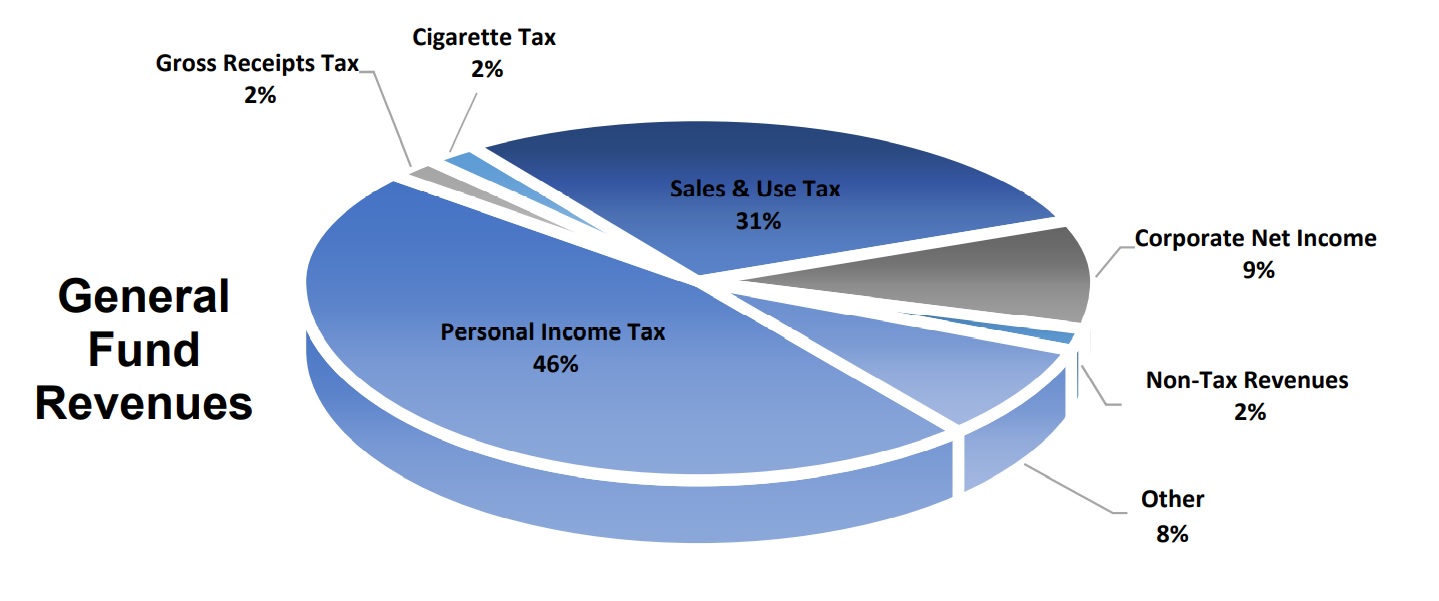

Gov Wolf S Proposed Budget Would Shift Education Spending Tax Burdens One United Lancaster

Form Rev 631 Fillable Brochure Tax Forgiveness For Pa Personal Income Tax

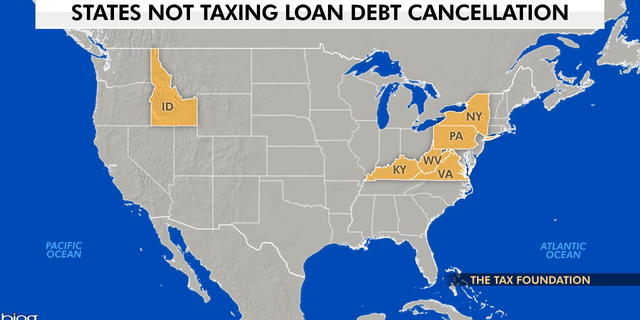

States Confirm Plan To Tax Student Loan Handout Funds Fox News

Cancelled Student Debt May Now Be Exempt From State Taxes In Pennsylvania Pennlive Com

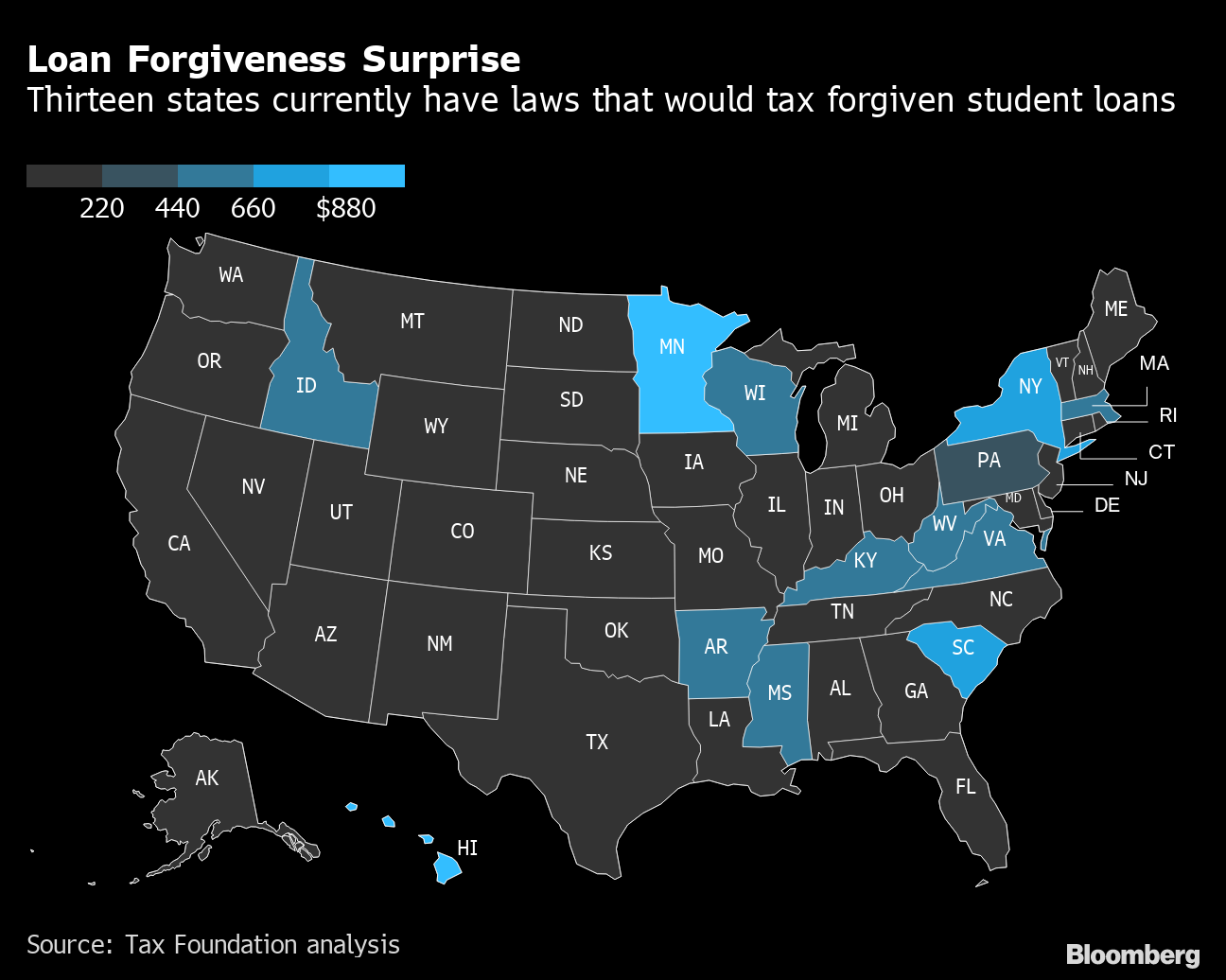

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

17 Tax Amnesty Illustrations Clip Art Istock

Form Pa 40sp Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance